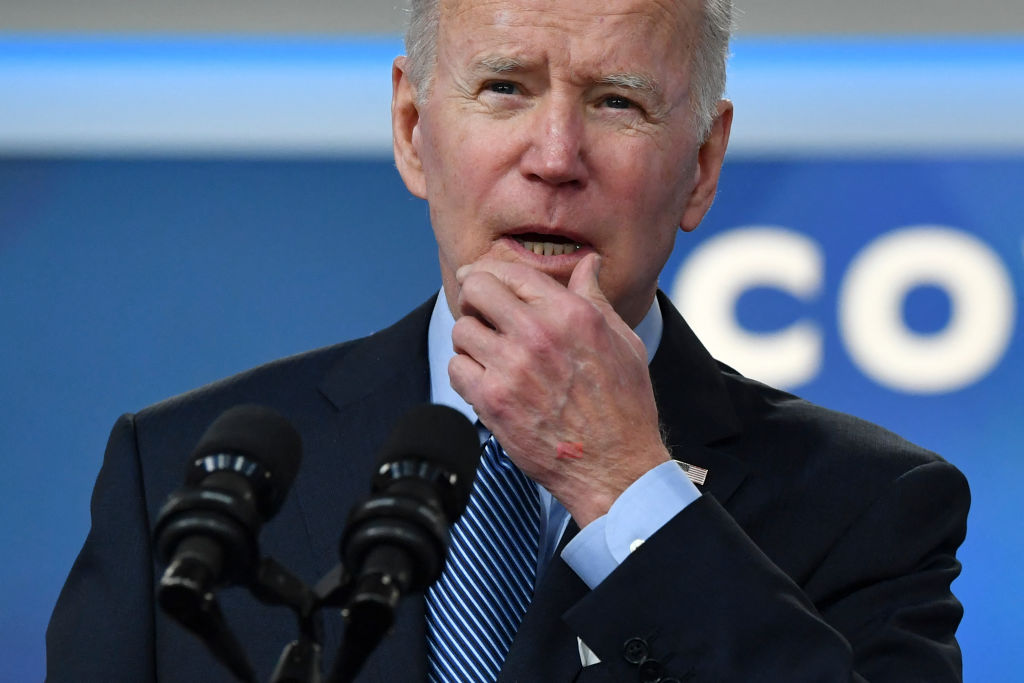

The top-ranking Republican member on the House Budget Committee said President Joe Biden’s proposed $5.8 trillion 2023 budget makes every crisis the American people are facing worse.

“When you testified last year on President Biden’s fiscal year ’22 budget, alarm bells were already going off about the impact that the president’s agenda would have on the economy, what it would have on inflation and the security of our southern border,” Rep. Jason Smith of Missouri told Office of Management and Budget Director Shalanda Young during a Tuesday hearing on Capitol Hill.

“At that time, the crises created by President Biden and the House and Senate Democrats’ agenda were already piling up,” he continued. “That list has only grown since, including an energy crisis with folks paying over $4 a gallon at the pump. In fact, since President Biden has been in office, gas prices went up 79 percent. That’s tough for the folks back home.”

Smith also listed what he called a crime crisis and an education crisis in the country.

“So now we have President Biden’s fiscal year ’23 budget, a proposal that deliberately makes every crisis American families are facing, because of President Biden and the one-party Democrat rule in Congress, that much worse,” the congressman said.

President Biden’s FY23 budget makes every single crisis that the American people are facing much worse. pic.twitter.com/yDxzmkut6y

— Rep. Jason Smith (@RepJasonSmith) March 29, 2022

Smith referenced Biden’s observation on Monday that “budgets are statements of values.”

“He values an economy where everything from the clothes you put on your back, food you put on your table to the gas is more expensive,” the congressman said.

The inflation rate was 7.9 percent in 2021 — the highest since 1982.

“He values open borders and energy dependence,” Smith said. “He values debt, a lot of it. Sixteen trillion dollars to be exact. The American people are not going to buy this budget, because frankly we can’t afford it.”

President Biden likes to say, “show me your budget, and I’ll tell you what you value.”

It’s clear from this budget that the President values a government that tells citizens how to live their lives, unaffordable prices, open borders, and energy dependence. pic.twitter.com/SVRy88Dqdz

— Rep. Jason Smith (@RepJasonSmith) March 29, 2022

The lawmaker noted that the president’s 10-year plan calls for spending $73 trillion and taking in $58 trillion in total taxes.

The proposal would take the nation’s overall debt from approximately $30 trillion to $45 trillion by 2032.

Sen. Rick Scott: “Biden’s budget is bad for American families. We already know we have $30 trillion worth of debt. Under his budget, the debt will increase over the next ten years to $14.4 trillion, which is over $100,000 per family.” https://t.co/kGxjU3UZoh pic.twitter.com/TA4XF6Oa9z

— The Hill (@thehill) March 29, 2022

That translates to over $1 trillion each year for the next decade.

“Just paying interest on that national debt is going to cost us $1.1 trillion,” Smith said.

He also addressed Biden’s proposed tax increases, which include taking the corporate tax rate from 21 percent to 28 percent, and a 20 percent wealth tax on those with assets of $100 million or more, asking Young the rationale behind the plan given the need for strong economic growth as the nation continues to emerge from the pandemic.

“The president’s been very clear, he will not subscribe to trickle-down economics,” the OMB director said, and his budget “invests” in the middle class.

[firefly_embed]

[/firefly_embed]

“Trickle-down economics” is a pejorative term Democrats use to describe the tax policies instituted under former presidents Ronald Reagan and Donald Trump.

Young also conceded that in spite of Biden’s promise that “nobody making less than $400,000 a year will pay a penny more in federal taxes,” his budget calls for tax rate reductions enacted under Trump to expire after 2025.

“So by expiration of the Tax Cuts and Jobs Act, that is going to raise taxes on every average-day American by $2,000 a year, and those are people making less than $100,000 a year, so in fact this budget does that,” Smith said.

“It also increases taxes on gasoline and fossil fuels by $45 billion over the next 10 years,” he further noted.

Richard Stern — a federal budget policy expert with the Heritage Foundation — told The Western Journal in an emailed statement that “Biden’s tax plan would fall squarely on the backs of hard-working American families.”

“Make no mistake, these tax hikes would directly result in lower wages, higher consumer prices, and reduced job opportunities for generations to come,” he said.

Stern also contended the “reckless plan” continues the spending policies that have sent inflation to a 40-year high.

On Monday, The Wall Street Journal editorial board highlighted that Trump’s tax cuts have worked as advertised.

Biden himself admitted as much when introducing his budget that same day, saying the gross domestic product grew 5.7 percent in 2021, the highest since Reagan was president in the early 1980s.

“This has led to a substantial increase in government revenues and dramatically improved our fiscal situation,” the president said, with the Trump tax cuts still in place.

The federal treasury took in a record $4 trillion in fiscal 2021, which included a 21-year high in corporate income tax revenue.

“In the first five months of fiscal 2022 through February, federal receipts climbed a remarkable 26% from a year earlier. That’s $371 billion more — to $1.8 trillion in five months. Individual income taxes rose $271 billion, or 38%, to $975 billion. Corporate income taxes rose 31%, or $28 billion, to $117 billion,” said the Wall Street Journal editorial, citing Congressional Budget Office numbers.

The treasury is on track to take in $4.5 trillion in fiscal 2022.

The editorial concluded, “The current tax system is throwing off revenue to spend if the politicians would show a modicum of restraint. Yet the Biden Administration is proposing $2.5 trillion in tax increases over 10 years.

“That would take the tax share of GDP to new records, and it’s the last thing that taxpayers or the economy need.”

This article appeared originally on The Western Journal.