Sen. Elizabeth Warren (D-Mass.) believes it is time to implement a wealth tax to help pay for a series of proposed policies.

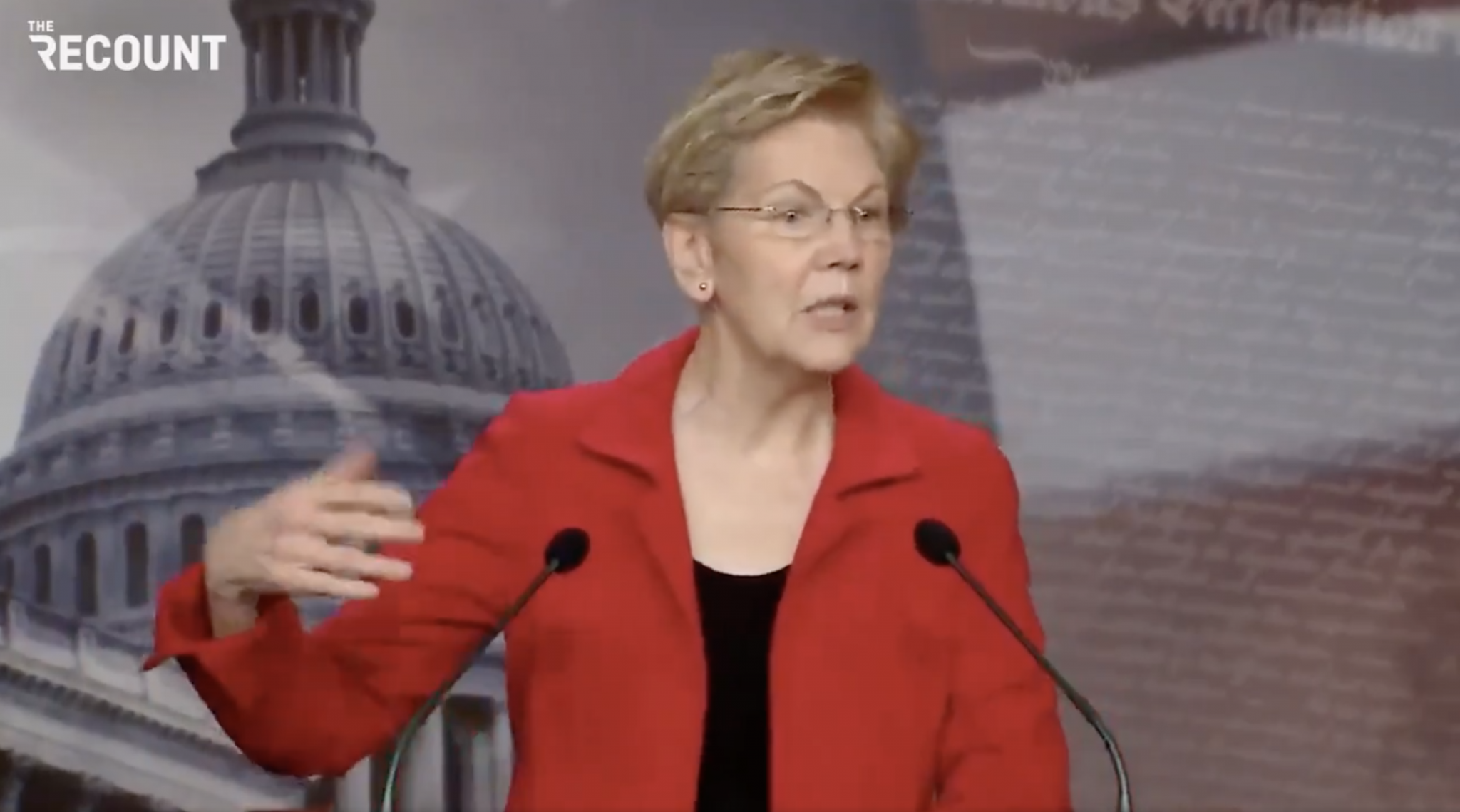

“It is time for a wealth tax in America,” Warren proclaimed on Monday as she introduced the Ultra-Millionaire Tax Act, which would implement a 2% tax on fortunes over $50 million.

She explained, “Your first $50 million is free and clear. But your 50 millionth and first dollar, you gotta pay two cents, and two cents on every dollar after that until you hit a billion. When you hit a billion, you gotta pay a few cents more.”

Watch the video below:

Sen Elizabeth Warren (D-MA) introduces the “Ultra-Millionaire Tax Act,” which imposes a 2 cent wealth tax on “fortunes above $50 million.”

— The Recount (@therecount) March 1, 2021

"It is time for a wealth tax in America." pic.twitter.com/K7p2b9lAyW

Warren and Reps. Pramila Jayapal (D-Wash.) and Brendan Boyle (D-Pa.) have argued that the tax can be used to help pay for President Joe Biden’s $1.9 trillion COVID-19 relief package.

As The New York Times reports, the bill would “apply a 2 percent tax to individual net worth — including the value of stocks, houses, boats and anything else a person owns, after subtracting out any debts — above $50 million. It would add an additional 1 percent surcharge for net worth above $1 billion.”

Warren’s bill is similar to a wealth tax she proposed while running for president.

University of California, Berkeley, economists Gabriel Zucman and Emmanuel Saez predict that Warren’s wealth tax would affect roughly 75,000 households and generate $2.7 trillion over 10 years.

The Massachusetts senator has previously suggested that the revenues from a wealth tax could be used to pay for free college tuition, universal pre-K, student loan debt forgiveness, and “down payments” for the Green New Deal and Medicare-for-All.

“A wealth tax is popular among voters on both sides for good reason: because they understand the system is rigged to benefit the wealthy and large corporations,” Warren said, adding, “As Congress develops additional plans to help our economy, the wealth tax should be at the top of the list to help pay for these plans because of the huge amounts of revenue it would generate.”

She also said she is confident that “lawmakers will catch up to the overwhelming majority of Americans who are demanding more fairness, more change, and who believe it’s time for a wealth tax.”

Continue with Google

Continue with Google