Rumpelstiltskin, the classic Brothers Grimm fairy tale, features an imp with the extraordinary ability to spin straw into gold. Similarly, Vice President Kamala Harris offers her own fairy tale policies.

Unfortunately, her corporate tax proposals, if enacted, would, in the spirit of the genre, essentially spin gold into straw.

Harris’ campaign spokesman claims her proposals are designed to “ensure billionaires and big corporations pay their fair share.” A central element of her tax agenda is to increase the corporate tax rate to 28% from 21% today.

The U.S. corporate tax rate is, at present, roughly average among industrialized countries. Raising it to 28% would saddle the U.S. with one of the world’s highest corporate tax rates.

Of the several reasons why raising the corporate tax rate is unwise, two demand special attention.

First, consider why, in 2017, Congress 1) slashed the corporate tax rate and 2) fundamentally changed how the U.S. taxes international income. Prior to those reforms, U.S. tax law motivated U.S.-headquartered multinational companies to “invert.” That is, it motivated them to get out from under U.S. tax law by becoming a subsidiary of a foreign-headquartered parent.

While the U.S. corporate rate remained stuck at 35% from 1994 to 2016, corporate tax rates worldwide fell steadily. As the rate differential increased, the number of inversions grew and, in the process, eroded the U.S. tax base.

The Federal Reserve Bank of St. Louis concluded in February 2017, “Inversions appear to be a symptom of a larger underlying problem, namely a U.S. corporate tax code that many say is sorely in need of modernization.”

Fortunately, the Tax Cuts and Jobs Act of 2017 (TCJA) fixed the problem. According to the Tax Policy Center, “Since enactment of TCJA, there have been no major tax-motivated inversion transactions.”

Vice President Harris proposes to undo the fix.

Kevin Brady, the former House Ways & Means Committee chairman who shepherded TCJA through Congress, warns what would happen if Congress increased the corporate rate: “You’ll see a return to where any time an American company is acquired by a foreign company, or even the other way around, it will likely be headquartered overseas because the tax code tells them that’s the best place to do it.”

Vice President Harris’ proposal to increase the corporate rate would precipitate new, unrelenting waves of inversions. It is the modern equivalent of spinning gold into straw.

Now consider the impact a higher corporate tax rate would have on economic growth. (Hint: It’s not pretty.)

The non-partisan Tax Foundation recently modeled the fiscal and economic impact of enacting various corporate tax rates. They found that raising the corporate tax rate to 28%, as Vice President Harris proposes, would add to the Treasury’s coffers but at the expense of economic growth.

Raising the federal corporate tax rate to 28% would boost federal revenue by $759 billion over the decade. The tax increase, however, would depress gross domestic product (GDP) by $1.32 trillion relative to current law. In other words, for every $1.00 of additional federal revenue, the economy would lose $1.74.

Again, Vice President Harris proposes the equivalent of spinning gold into straw!

Alternatively, the Tax Foundation found that cutting the corporate rate to 15%, as former President Trump proposes, would boost cumulative U.S. GDP over ten years by $952 billion. Federal revenue over that period would fall by $459 billion relative to current law. In other words, GDP would increase $2.07 for every dollar of federal revenue loss—the equivalent of spinning straw into gold.

The Brothers Grimm fairy tales are scary and often gruesome. Thus, the fairy tale nature of Vice President Harris’ corporate tax policies should be apparent to anyone who considers how they would impact the economy.

One thing is certain: Should the 119th Congress increase the corporate tax rate to 28%, this fairy tale won’t end with, “Happily ever after.”

Following a two-year stint in the White House as an Associate Director of the National Economic Council, James Carter served as a Deputy Assistant Secretary of the Treasury and Deputy Undersecretary of Labor for President George W. Bush.

The views and opinions expressed in this commentary are those of the author and do not reflect the official position of the Daily Caller News Foundation.

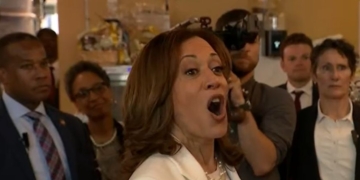

(Featured Image Media Credit: Screen Capture/CSPAN)

All content created by the Daily Caller News Foundation, an independent and nonpartisan newswire service, is available without charge to any legitimate news publisher that can provide a large audience. All republished articles must include our logo, our reporter’s byline and their DCNF affiliation. For any questions about our guidelines or partnering with us, please contact [email protected].

Continue with Google

Continue with Google