The collapses of both Silicon Valley Bank and Signature Bank are raising concerns among Americans and what this means for their own assets.

During an interview with IJR, financial advisor, speaker, and entrepreneur Winnie Sun explained what exactly happened with the collapses and whether Americans should be worried.

The collapse of Silicon Valley Bank resulted in the second-largest failure of a financial institution in the history of the United States.

What role do banks play?

Sun explained when an individual goes to a bank and makes a deposit, “You assume many times that the bank is holding the cash. But, what they really do is they take a portion of that – those deposits – and they actually invest it in some more lower risk investments such as bonds.”

She explained, “They invested in these bonds… so they have a certain amount in reserves so that they satisfy regulators… in the case you do need to go to the bank, you can get some of your cash out. They’re just assuming not everyone is going to go to the bank to get their cash out because some of us invested in these bonds.”

So what happened with Silicon Valley Bank?

“They were heavily concentrated in technology, in sciences, and startups. So, this made up over 50% of their clientele. Which, we know, when it comes to investing is never a good idea when you’re too concentrated in one area,” Sun said.

Noting some of the “executives did some activities,” Sun added, “The stock price dropped tremendously, and some of those customers who used Silicon Valley Bank got nervous. And, some of them were venture capitalists who then reached out to the companies they work with and told them to go ahead and get their money out.”

Earlier this week, it was reported that executives at Silicon Valley Bank sold $84 million in stock over the past two years, raising concerns about the issue of insider trading.

Last week, shares in Silicon Valley Bank dropped 60%.

CNBC noted that several venture capital funds suggested that companies in their portfolios transfer their funds out of the bank.

This does not appear to be an illegal practice.

During the interview, Sun did note that if this had not taken place within a matter of days the bank probably would not have collapsed.

“Meaning that all these people did what they call a bank run,” Sun said.

What is a bank run?

CNN explained that a bank run takes place when “customers panic and everyone tries to get their money out at once.”

“It’s almost like the customers, because they rushed because they were nervous, they actually caused the bank to collapse more rapidly,” Sun told IJR.

Additionally, Sun pointed out that because Silicon Valley Bank is located in Santa Clara, California, it is “technology savvy.”

As a result, customers are able to take out their money more quickly because a lot of it was done online, as Sun explained.

Should the average American be concerned?

When asked how she would address concerns Americans have about their own assets, Sun replied, “For most Americans, this is not going to be such an issue. Under $250,000 in the bank is covered by FDIC insurance.”

She continued, “If each of those accounts is under $250,000 then you should not lose sleep. However, if it is over $250,000, then you should consider: Why do you have so much cash?”

On the matter of cash, Sun said it generally “does not earn a lot of interest so it’s usually not working that hard for you.”

Sun suggested reaching out to a financial advisor for direction.

If it is necessary for an individual to keep a significant amount of cash on hand, she suggested it is a good time to “think about divvying it up to other financial firms so that you can maximize your FDIC insurance.”

The financial advisor shared that this is a good opportunity to take “advantage of refreshing all your financial accounts. Not just your bank accounts but also your investment accounts.”

Why should it matter if it does not affect me?

“Why it is important for the average American to know this is because we need to be able to discuss it. We do know that especially with the pandemic this has caused inflation, so the cost of goods when we go to the grocery store is a lot more expensive now,” Sun said.

The federal government is working to increase interest rates as a way to mitigate inflation, as Sun noted.

“People are more cash strapped, they feel like they don’t have as much money, they don’t feel like they’re earning as much money, they’re worried about their retirement, because the stock market hasn’t been great in 2023,” she added.

Regulators have proceeded to take care of the cash deposits at Silicon Valley Bank and that will not cost taxpayers anything, according to Sun.

President Joe Biden also said this week that “no losses” from the collapse would be taken on by taxpayers.

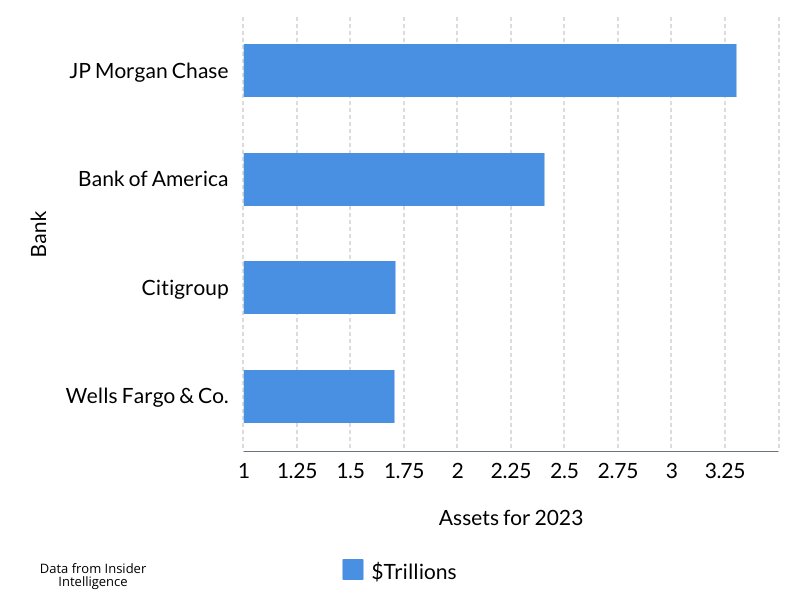

How much are Silicon Valley Bank and Signature Bank worth in comparison to others?

The Washington Post noted, as of December 2022, Silicon Valley Bank had $209 billion in assets while Signature Bank held $110 billion in assets.

While that could be considered a hefty amount in assets, they rank behind that of other larger banks including JP Morgan Chase and Bank of America.

See how the bigger banks rank against each other below, per Insider Intelligence:

Why does this matter?

“With smaller banks, you can quickly disrupt their balance if too many people go and withdraw funds too quickly,” Sun said to IJR.

What about the investigation?

On Tuesday, it was reported that the Securities and Exchange Commission and the Justice Department are investigating the Silicon Valley Bank collapse.

Individuals familiar with the issue said the agencies are looking into stock sales executives participated in ahead of the incident.

“I think an investigation should take place. I think we need to wait to find out what they did and didn’t do,” Sun said.

She suggested if there was “wrongdoing, I think that they should be fairly tried and make sure that doesn’t happen in the future.”

Sun argued these regional banks and large banks “should expect that to happen because they want to show that they deserve new assets and other customers as well.”

Could the nation see another failure such as that of 2008?

“I think we learned a lot from the Washington Mutual days… there’s a lot of companies that have failed,” Sun said to IJR.

However, that does not mean there is still not a risk.

“The reason why risk still remains is because legislation changes have occurred during that time. And, not only that, as Americans are more skittish and worried today than they were five years ago,” Sun said.

Individuals also tend to do things that do not make sense when they are scared, according to Sun.

“We should try and keep everyone calm and steady and focused on what you do best. Focus on earning money, focus on things that you can control. But, the banking system, if you’re under $250,000, just let it be,” she added.

In 2008, Washington Mutual became the largest failed bank in U.S. history.

The Washington Post explained the 2008 crisis was the worst since the Great Depression as the “stock market plummeted, wiping out nearly $8 trillion in value between late 2007 and 2009.”

Additionally, “Unemployment climbed, peaking at 10 percent in October 2009. Americans lost $9.8 trillion in wealth as their home values plummeted and their retirement accounts vaporized,” per the Post.

Not just the average American

It appears that not only average Americans are nervous about the banking system.

On Wednesday, The New York Times reported the S&P 500 fell 2% on Wall Street as investors have their own concerns with the matter.

Continue with Google

Continue with Google