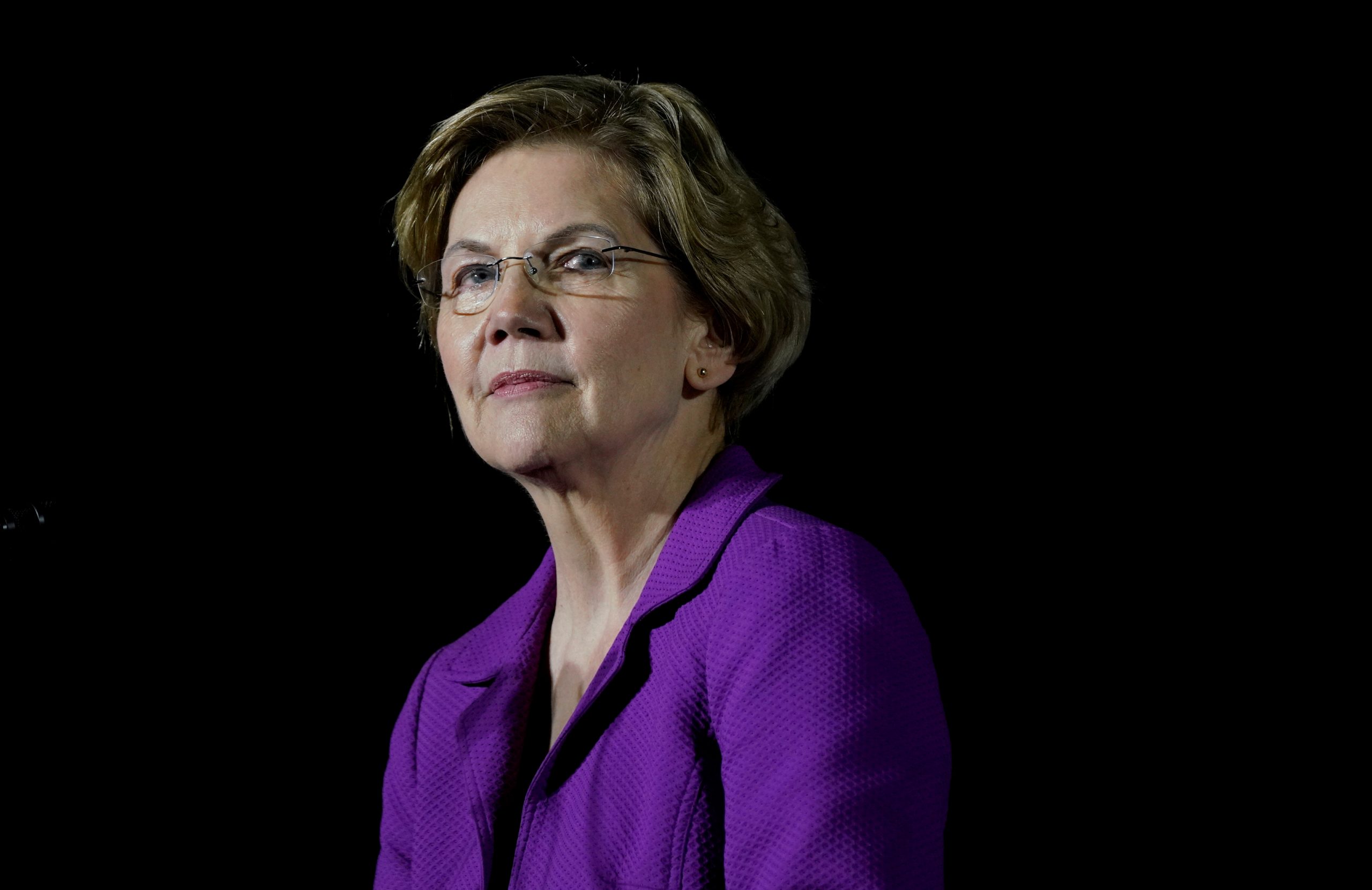

Democratic Sen. Elizabeth Warren of Massachusetts has introduced a bill that would triple the budget of the Internal Revenue Service, a proposal that is sure to make many hardworking taxpayers infuriated.

The Restoring the IRS Act of 2021 would nearly triple the budget of the government agency from $11.8 billion to $31.5 billion for mandatory annual spending.

Warren said that the goal of the proposal is to go after wealthy Americans and corporations that might be gaming the tax system.

“For too long, the wealthiest Americans and big corporations have been able to use lawyers, accountants, and lobbyists to avoid paying their fair share — and budget cuts have hollowed out the IRS so it doesn’t have the resources to go after wealthy tax cheats. The IRS should have more — and more stable — resources to do its job, and my bill would do just that,” Warren said, according to a Monday news release.

The release cited a study from the National Bureau of Economic Research which suggests that the top 1 percent of income earners in the United States underreport a fifth of their yearly incomes.

In addition, Warren referenced a hearing with IRS Commissioner Charles Rettig, where he said that the agency would greatly benefit from mandatory funding.

“In the last decade, our enforcement personnel — we’ve lost 17,000 enforcement personnel. So we have 17,000 fewer people to do exactly what you’re asking and the point is we actually have 6,500. That’s our population that go after the high income taxpayers, the most egregious cases, and the corporate world. So, if you were to add 17,000 to 6,500, I think you would see a reversal in those numbers,” Rettig said in March.

“Mandatory, consistent, adequate multi-year funding allows us to plan appropriately. Every time we go into hiring, we have a concern whether we can actually feed those folks the next year,” he later added.

For those who do not think the wealthy pay their “fair share”, the top one percent of earners currently pay 38.5 percent of all income taxes in the United States, according to the Tax Foundation.

Warren’s bill falls in line with President Joe Biden’s plan, which would add 87,000 employees to the agency to crack down on “tax cheats,” Politico reported.

This crackdown would rely on the support of banks to help the government determine if there is a gap between how much somebody owes and what they actually paid.

Drastically expanding taxpayer funding for the organization responsible for taxpayer funding is a sick bureaucratic joke.

While targeting the one percent on paper sounds enticing, it is inevitable that this rapid expansion would trickle down to the American middle class being singled out as well.

“Instead of promising a chicken in every pot, Biden’s plan promises an auditor at every kitchen table,” Republican Iowa Sen. Chuck Grassley notably said about Biden’s plan, Reason reported.

TAXES: At Tuesday’s Senate GOP leadership press conference, @SenJoniErnst (R-IA) accused the Biden Administration of a tax plan that acts as a “giveaway” to “coastal elites”:

“This is probably the only time that I will agree with @AOC.” pic.twitter.com/ugBIgVUCVD

— Forbes (@Forbes) May 23, 2021

Plans from fiscal liberals like Biden and Warren usually serve as nothing but political ploys which will help them win over votes, and it is the average American who always suffers as a result.

Neither party seems to be terribly interested in cutting back wasteful spending, so Americans should remain on alert about how tax policy will change under the current Democratic leadership.

This article appeared originally on The Western Journal.