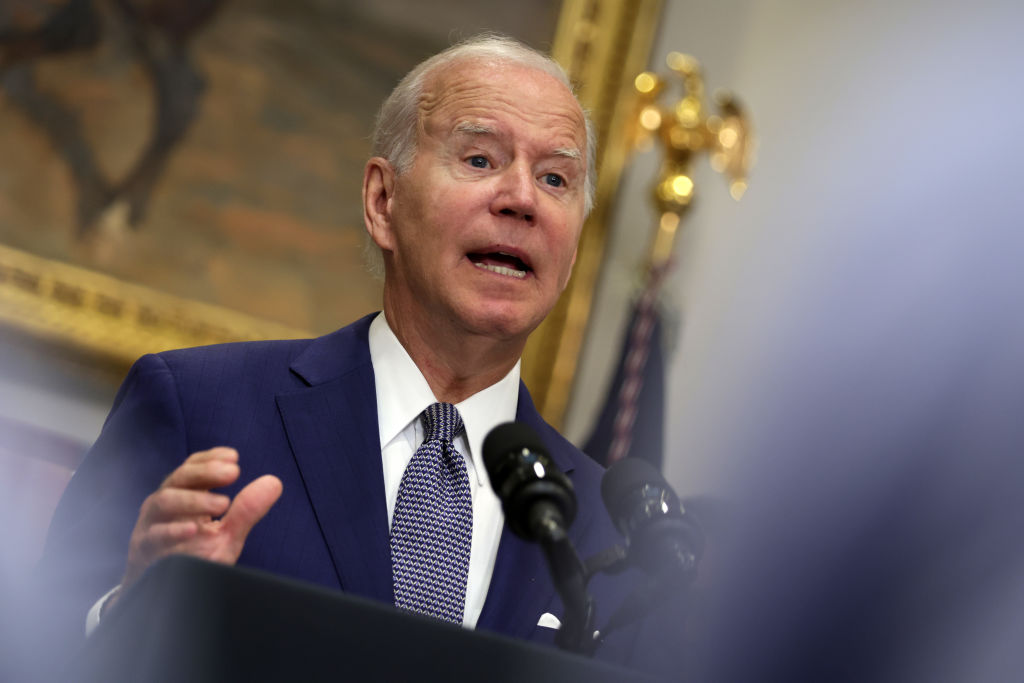

With The Washington Post blaring that “Big Tech is bracing for a possible recession,” the Biden White House is redefining the word.

A recession is traditionally defined as two consecutive quarters in which the nation’s Gross Domestic Product shrinks. A new report Thursday will assess the results of the second quarter. Shrinkage took place in the first quarter, and with inflation running at 9.1 percent, there’s not a lot of hope for economic good news.

As noted by Business Insider, economists Bloomberg surveyed believe growth will be a paltry 0.9 percent, but the Federal Reserve Bank of Atlanta’s GDPNow model pegs shrinkage at 1.6 percent.

“The big headwinds for consumers are price inflation and higher interest rates. And inflation could erode the excess savings consumers accumulated through the pandemic, especially if price increases continue to run ahead of wage growth,” Capital One CEO Richard Fairbank said Thursday, according to CNN.

“We’re seeing an increase in bad debt to slightly higher than pre-pandemic levels as well as extended cash collection cycles,” AT&T CEO John Stankey said the same day.

Yellen: There’s an org called the National Bureau of Economic Research that looks at a broad range of data…I will be would be amazed if the NBER would declare this period to be a recession

FLASHBACK: in ’08, NBER didn’t announce until Dec the recession had begun A YEAR EARLIER

— Jacqui Heinrich (@JacquiHeinrich) July 24, 2022

But consumer pain does not make a recession, according to a White House handout,

“What is a recession? While some maintain that two consecutive quarters of falling real GDP constitute a recession, that is neither the official definition nor the way economists evaluate the state of the business cycle. Instead, both official determinations of recessions and economists’ assessment of economic activity are based on a holistic look at the data,” the handout said, listing labor market, consumer and business spending, industrial production and income data will all be mined.

The White then offered a prediction: “Based on these data, it is unlikely that the decline in GDP in the first quarter of this year — even if followed by another GDP decline in the second quarter — indicates a recession.”

Despite the growing mountain of gloomy economic forecasts, the handout said, “Recession probabilities are never zero, but trends in the data through the first half of this year used to determine a recession are not indicating a downturn.”

In fact, it said, “There is a good chance that the strength of the labor market and of consumer balance sheets help the economy transition from the rapid growth of the last year to steadier and more stable growth.”

Biden owns this recession. He is the WORST president in American history.

— Proud Elephant ?? (@ProudElephantUS) July 21, 2022

Former Treasury Secretary Lawrence Summers was not as chipper. In a Sunday interview, he called chances of coming out of the battle against inflation without a scarred economy “very unlikely,” according to Bloomberg.

“There’s a very high likelihood of recession when we’ve been in this kind of situation before,” he said.

“Recession has essentially always followed when inflation has been high and our employment has been low,” he said.

Summers said new policies are needed.

“There’s a lot we can do to contain or control inflation,” he said. “But if we continue with the kind of ostrich policies we had in 2021, there’s going to be much, much more pain later.”

This article appeared originally on The Western Journal.